If you’re currently struggling with debt and searching for a way out, you might have come across Slate Legal Group. But who exactly is this company, what services do they offer, and what are the reviews saying? In this article, we’ll delve into the details of Slate Legal Group and explore whether it’s a trustworthy option for debt relief.

What is Slate Legal Group?

Slate Legal Group is a Debt Relief law firm specializing in debt settlement. It’s worth noting that Slate Legal Group seems to be part of a larger network of firms that share similar characteristics and objectives. Often, these types of organizations are affiliated with bigger entities.

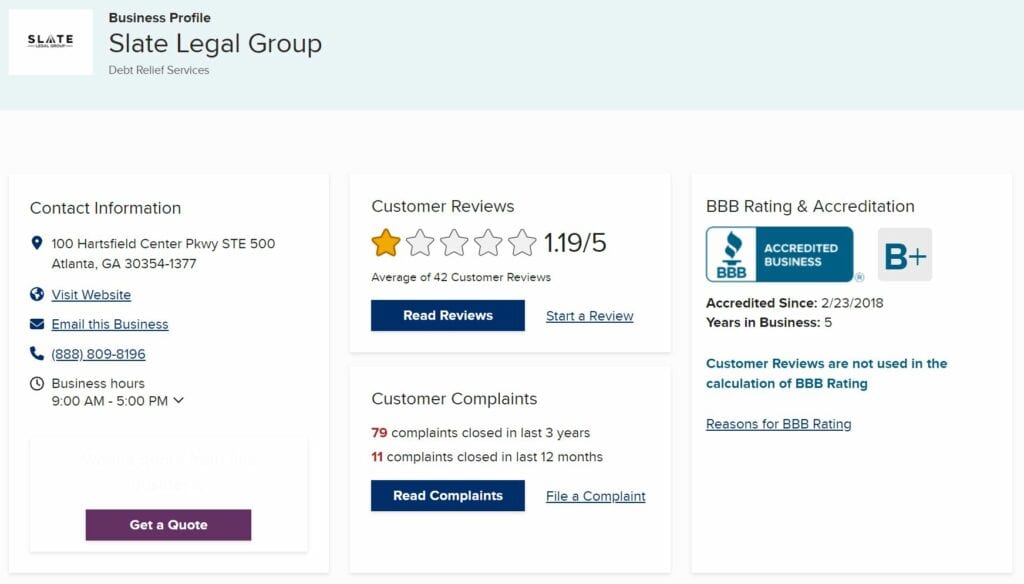

When examining such companies, it’s important to consider the age of their website and gather as much information as possible about the company itself. In the case of Slate Legal Group, their website has been around for nearly 5 years, according to BBB (Better Business Bureau), although the website itself is only 3 years old. This could suggest some inconsistencies or changes in the company’s operations over time.

Unbiased Reviews: BBB and Google

When evaluating the credibility and reputation of a company, two of the most reliable sources are BBB and Google reviews. These platforms offer valuable insights into customer experiences and help paint a comprehensive picture of the company’s performance.

BBB Reviews

Slate Legal Group currently holds a 1.19 rating on BBB based on 42 reviews, along with a B+ rating. It’s essential to approach these reviews with caution, as such low ratings may indicate underlying issues within the organization. One possibility is that individuals are being signed up for Slate Legal Group by third parties, which could account for the dissatisfaction expressed by many customers. This raises questions about the company’s direct marketing practices and the overall satisfaction of its clients.

My husband and I began the program in February 2021 and have paid them $18,500.00. They have negotiated current payment plans on some of our debts, but they only follow up with our creditors when we receive a notice of a summons from the court and send them the paperwork. By the time late fees and interest increase over time, the debt ends up being so much higher than when we initially enrolled in the program. Therefore the settlement offers after negotiations are very poor in my opinion. When we got behind, we should have negotiated directly with our creditors. Most of our payments have gone to their initial fees. It is like we paid them to make our situation more stressful than it already was! Back in December of 2022 they attempted to negotiate a debt for about $200 more than the original balance and wanted us to deposit $300 that day. It was two days before Christmas and we didn’t want to send them any more money than we already have. so we said we need more time. We have not heard from them since and we call every week. The attorney assigned to the case has been of no help either. He does not reply to emails in a timely manner at all. My husband was very ill and we got behind on bills and now there seems no light at the end of the tunnel. I sincerely hope the BBB can help us with this company. If nothing can be done to help us at this point, I am just hoping the next person reads their horrible reviews before they commit. We are certainly not their only clients that have had a horrible experience.

The process & everything was easy. Getting the paper trail information is like pulling teeth. I exited the program on Jan 19th, 2023, so I can close on my house but I need the follow-up letter, they said it would be 3-5 business days it is now Feb 4th and I’m still waiting and now can’t close on my house… I have called 3 times since Jan 26th with a run around that I will get the information. They have jeopardized my percentage rate which is up as of Feb 6th.

Google Reviews

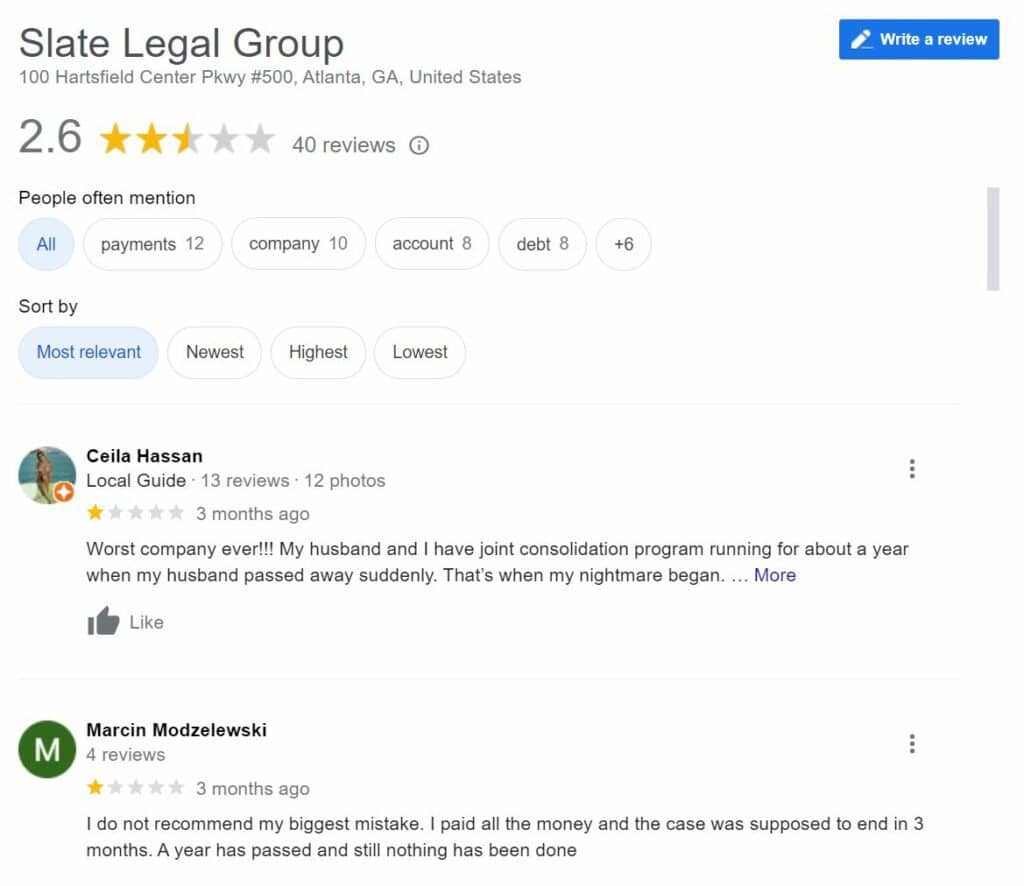

On Google, Slate Legal Group has an average rating of 2.6 based on 40 reviews. The feedback on this platform also echoes the sentiments expressed on BBB. One recurring complaint is that Slate Legal Group often charges fees before achieving settlements. This raises concerns about their financial practices and whether they prioritize their own profits over the clients’ best interests. Additionally, the Google reviews highlight a lack of responsiveness and poor customer service from the company. Some customers even had to contact Slate Legal Group to remind them to make payments on their behalf.

Exploring Your Options

If you find yourself questioning what steps to take next, don’t worry—you’re not trapped in your program with Slate Legal Group. You have several options to consider. First, try reaching out to the company directly or contact your bank for assistance if you’re having trouble getting in touch with Slate. It’s important to maintain communication and actively seek solutions.

If you’re considering staying with Slate Legal Group, it’s crucial to thoroughly read the Client Services Agreement to understand the terms and conditions. Pay close attention to their fee structure and why they charge fees before any settlements are achieved. By gaining clarity on their processes, you can make an informed decision about the value they provide and whether it aligns with your expectations.

FAQs

1. Is Slate Legal Group a trustworthy option for debt relief?

Answer: Slate Legal Group has received mixed reviews and customer feedback raises concerns about their trustworthiness. It is crucial to thoroughly evaluate their services, considering the negative reviews and complaints regarding their transparency, customer service, and overall effectiveness.

2. How effective is Slate Legal Group in negotiating debt settlements?

Answer: The effectiveness of Slate Legal Group in negotiating debt settlements has been questioned by some customers. Negative reviews suggest limited success in achieving significant reductions in debt amounts or securing favorable settlement terms.

3. Can Slate Legal Group handle various types of debt effectively?

Answer: While Slate Legal claims to handle various types of debt, customer experiences indicate potential limitations. Negative reviews have raised concerns about their ability to effectively manage and negotiate different types of debt, leading to dissatisfaction among some clients.

4. Does Slate Legal Group prioritize transparency throughout the debt relief process?

Answer: Concerns have been raised regarding Slate Legal’s transparency in its services regarding your credit card debt. Negative reviews suggest a lack of clarity surrounding fees, monthly payments, settlement negotiations, terrible customer service, and overall progress. Clients should exercise caution and ensure a clear understanding of the services provided.

5. What are the potential hidden fees associated with Slate Legal Group’s debt relief services?

Answer: Some customers have expressed concerns about potential hidden fees associated with Slate Legal’s services. Negative reviews highlight instances where clients discovered unexpected costs, emphasizing the need for careful review and clarification of all fee-related information. Also, their negotiations are not done in a timely manner.

6. How long does it typically take to see satisfactory results with Slate Legal Group’s debt settlement process?

Answer: Negative reviews and customer feedback suggest that clients may experience delays in achieving satisfactory results with the Slate Law Group debt settlement process. Extended timeframes for settlements or resolution of debts have been reported, requiring realistic expectations and patience.

7. Are there any potential drawbacks to working with Slate Legal Group?

Answer: Drawbacks reported by some customers include a lack of responsiveness and poor customer service from Slate Legal. Negative reviews indicate difficulties in obtaining updates, limited communication, and overall dissatisfaction with the level of support provided.

8. What are the risks of entrusting debt settlement negotiations to Slate Legal Group?

Answer: Risks associated with Slate Legal may include limited success in reducing debt amounts, potential damage to credit scores, and the possibility of facing legal actions or collection efforts from creditors. It is essential to carefully consider these risks before making a decision.

9. Can Slate Legal Group guarantee specific outcomes in debt relief?

Answer: Slate Legal, like many debt relief companies, cannot guarantee specific outcomes. It is crucial to approach their services with caution and realistic expectations, considering the potential risks and limitations involved in the debt relief process.

10. Are there alternative debt relief options that may be more reliable than Slate Legal Group?

Answer: Considering the concerns raised about Slate Legal Group’s services, exploring alternative debt relief options such as credit counseling, debt consolidation, or reputable nonprofit organizations may be advisable. It is important to conduct thorough research and seek professional advice to make an informed decision based on individual circumstances.

Conclusion

In conclusion, when considering debt relief options, it is crucial to exercise caution and thoroughly evaluate the reputation and customer feedback of companies like Slate Legal Group. While they claim to offer debt settlement services, the mixed reviews and negative feedback raise concerns about their transparency, effectiveness, and customer service.

It is important to consider the potential risks and limitations associated with Slate Legal Group’s services. Negative reviews highlight issues such as limited success in negotiating debt settlements, delays in achieving satisfactory results, and potential hidden fees. Additionally, concerns have been raised about their responsiveness and overall level of support provided to clients.

Given the negative feedback surrounding Slate Legal Group, it may be prudent to explore alternative debt relief options. Consulting with a reputable credit counselor, considering debt consolidation programs, or seeking assistance from nonprofit organizations can provide more reliable and trustworthy avenues for debt management.

Remember, making informed decisions about debt relief requires thorough research, an understanding of the terms and conditions, and consultation with professionals who can provide personalized advice based on your specific financial situation.