Are you considering working with Option 1 Legal for debt settlement? Have you come across mixed reviews and are unsure about the legitimacy of this debt relief law firm? In this article, we will delve into the details of Option 1 Legal, explore the reviews, and provide you with valuable insights to help you make an informed decision.

What is Option 1 Legal?

Option 1 Legal is a debt relief law firm that specializes in debt settlement. While it presents itself as a potential solution for individuals struggling with credit card debt, it is important to thoroughly research any company before committing to their services, especially when it comes to matters as crucial as your financial well-being.

Upon investigating Option 1 Legal, it becomes apparent that this firm may be associated with a larger organization, as there seem to be other similar companies operating in the same realm. However, it is essential to focus on Option 1 Legal specifically to assess its credibility and effectiveness in providing debt relief services.

Option 1 Legal Reviews

When evaluating the reputation of any company, it is wise to consult unbiased and comprehensive review platforms such as the Better Business Bureau (BBB) and Google Reviews. Let’s take a closer look at what these sources reveal about Option 1 Legal.

BBB

On the BBB website, Option 1 Legal currently holds a low rating of 1.1 based on 30 reviews and has received an F rating. These ratings raise concerns and prompt further investigation into the company’s practices. One particular review stands out, where a client claimed to have paid $17,000 over 42 months, but Option 1 Legal only settled two accounts amounting to $5,000.

This leaves the individual questioning where the remaining $12,000 went. Another reviewer mentioned that their initial debt of $5,500 increased to $11,000 after enrolling with Option 1 Legal due to what they perceived as the firm’s incompetence. Both reviews caution against working with Option 1 Legal, suggesting that it may be a scam. Here are some of the latest reviews on the BBB.

Better off declaring bankruptcy than dealing with this company. Just paid my last payment, the 42nd payment, 20% of my debt has been supposedly dealt with and they say they need another 10 payments to finish their contracted job, Scam $19000 paid and the only thing they’ve done is set up a payment plan with 1 debtor, been sued an lost on 3 debtors because they never even contacted the company…Joke

Option One is a scam…As I am reading all of your reviews I am going through the same situation with this Company. I already made my payments of $400 for 42 months which is almost 17,000. They have only paid 2 of my credit cards which they settle for $5000. Now they want to extend the program so I can give them more money. So what happened with the $12,000 that has already been paid??? like seriously. That is not what we agreed on from the start they said, I was only going to pay $17,000 and they will cover all my debt. I guess not. Have any of you got your money back or resolved this issue? I mean is more than $10,000 that they are taking from me and I don`t find it fair. Please do not go to these people they are taking your money. I feel that I would have been better off making an agreement myself with the creditors. FYI ( 0 on the Starts)

Worst experience! My total debt was a little over 28K they told me I can settle for way less around 20k ( mind you, they reached out to me initially) I don’t like companies that take advantage of people especially when they are mentally or emotionally having a hard time going through financial hardship. They painted the outcome to be great and here I am regretting it. I’m going to end up paying close to the Initial amount of 28k, I understand it might vary, but if I knew there was not going to be much of a difference I would have never made such a decision. I got my credit from 800 + to below 600. Guess what though they manage to collect their money, so I practically paid close to the full amount initially owed for them to put it in their pocket, plus OMG horrible customer service. I made big payments 3k, and 2k, and thought I was done. I still owe them around 5k which is 5k more than what they told me I will be settling for. I’m not working, got laid off. I’m a full-time college student (Social Work) I had to take a college loan just to pay them more money. This is emotionally and psychologically overwhelming. Im a single mom of 2. They are a FRAUD & they need to be stopped. How many complaints?

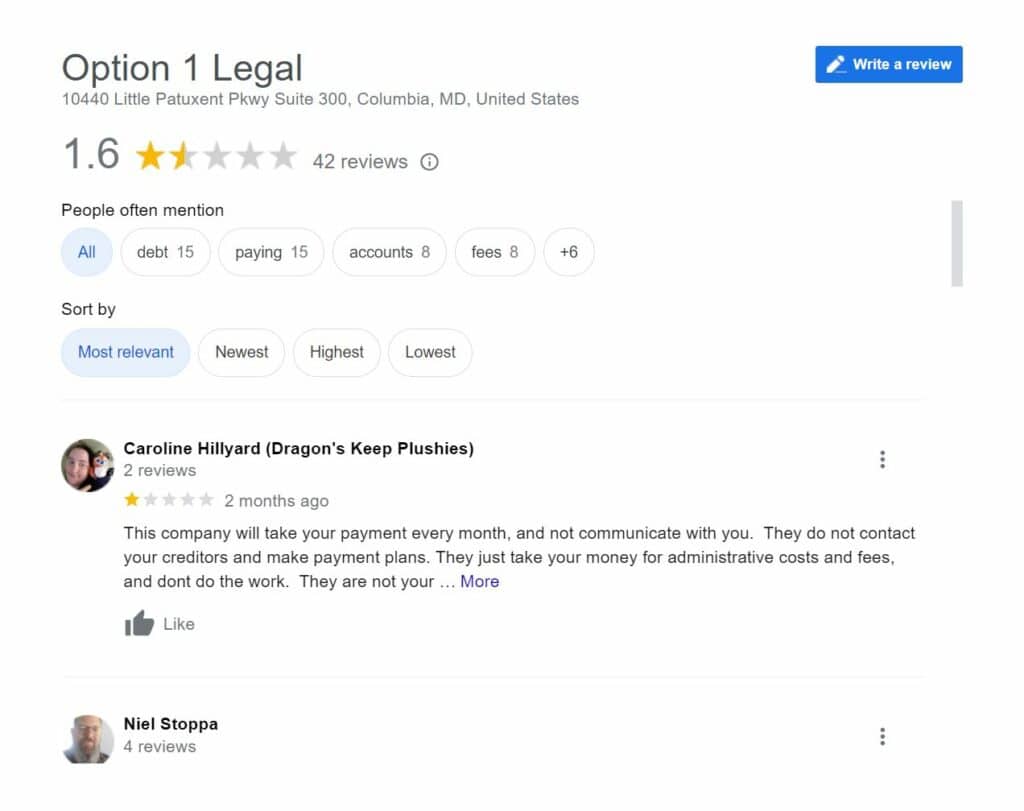

On Google reviews, the company holds a rating of 1.6 based on 41 reviews. Similar to the BBB reviews, several individuals on Google also express dissatisfaction with the company’s services. One customer claimed to have paid $13,000 into a savings account, but after deducting fees, only $2,000 remained. Another reviewer criticized Option 1 for poor communication and lack of actual services, stating that the firm only deducted fees without providing any meaningful assistance. These negative experiences mentioned in the reviews further raise doubts about the legitimacy and efficacy of Option 1.

Analyzing the Reviews

While negative reviews can be subjective and do not provide a comprehensive picture, the recurring themes of miscommunication, excessive fees, and lack of settlement progress cannot be ignored. These patterns suggest potential issues with Option 1’s approach and execution of their debt relief services. It is crucial to consider these factors when deciding whether to engage with the company.

Your Options

If you find yourself in a position where you are considering canceling your engagement, there are a few courses of action you can take. First, attempt to contact the company directly to discuss your concerns and explore the possibility of cancellation. However, if the company proves uncooperative, you may need to involve your bank to seek assistance in discontinuing the program. Always remember to carefully review any agreements or contracts you have signed to understand the terms and conditions surrounding cancellations.

If you still wish to pursue working with them, it is crucial to thoroughly examine their Client Services Agreement. Pay close attention to the fee structure and ensure you understand.

FAQs

How does Option 1 Legal differentiate itself from other debt relief firms?

Option 1 Legal distinguishes itself by positioning itself as a debt relief law firm, not a debt consolidation company, utilizing legal expertise to negotiate settlements with creditors on behalf of clients. Their focus on legal strategies sets them apart from traditional debt settlement companies since they seem to not be a fair and appropriate solution.

What is the fee structure of Option 1 Legal?

Option 1 Legal operates on a fee-based system. While specific fee details may vary, it is important to review the Client Services Agreement thoroughly to understand the percentage fees charged and when they are deducted from your monthly payments.

How long does the debt settlement process with Option 1 Legal typically take?

The duration of the debt settlement process can vary depending on individual circumstances and the complexity of the debts involved and the debt collector. Option 1 Legal should provide you with an estimated timeline during your initial consultation based on their experience and past case and complex financial problems.

What happens if a settlement cannot be reached with a creditor?

In cases where a settlement cannot be reached with a creditor, Option 1 Legal will typically continue negotiating or exploring alternative strategies to resolve the debt. They may advise on other debt-relief options, such as debt management or bankruptcy, depending on your specific situation.

Can I cancel my agreement with Option 1 Legal at any time?

Cancellation policies may vary, so it is crucial to carefully review the Client Services Agreement. While some agreements may allow for cancellation at any time, others may have specific conditions or fees associated with termination. Contact Option 1 Legal directly for clarification and to understand the cancellation process.

How does Option 1 Legal communicate with clients throughout the debt settlement process?

Clear and effective communication is essential in any debt settlement process. Option 1 Legal should provide regular updates on the progress of negotiations, any settlements reached, and any changes or developments in your case. They may utilize phone calls, emails, or an online client portal to facilitate communication.

Will using Option 1 Legal negatively impact my credit score?

Engaging in debt settlement can have an impact on your credit score. It is important to understand that missed payments or negotiated settlements may be reported to credit bureaus, potentially affecting your creditworthiness. Option 1 Legal should provide guidance on how their services may impact your credit and discuss potential credit-rebuilding strategies.

Are there any alternative debt relief options that Option 1 Legal can recommend?

Option 1 Legal should be knowledgeable about various debt relief alternatives beyond settlement. They may provide insights into debt consolidation, credit counseling, or bankruptcy as potential options based on your specific financial situation and goals.

Can Option 1 Legal assist with all types of debts, including credit card debts, medical bills, and personal loans?

Option 1 Legal typically handles a variety of unsecured debts, including credit card debts, medical bills, personal loans, and other types of consumer debts. However, it is advisable to consult with them directly to confirm whether your specific debts fall within their scope of services.

What qualifications and certifications do the attorneys at Option 1 Legal possess?

Option 1 Legal positions itself as a debt relief law firm, implying that its team includes attorneys knowledgeable in debt settlement and related legal matters. It is reasonable to inquire about the qualifications, experience, and certifications held by the attorneys who will be handling your case to ensure you are comfortable with their expertise.

Conclusion

After a careful examination of Option 1 Legal and its reviews, it is evident that the company’s reputation raises significant concerns. With low ratings on both the Better Business Bureau and Google reviews, numerous customers have expressed dissatisfaction with Option 1 Legal’s services.

The recurring complaints of excessive fees, lack of settlement progress, and poor communication paint a troubling picture. These negative experiences raise doubts about the company’s legitimacy and effectiveness in providing debt relief solutions. While it is essential to approach online reviews with caution and consider the subjective nature of individual experiences, the consistency of these complaints cannot be ignored.

When faced with the decision of whether to engage with Option 1 Legal, it is crucial to prioritize thorough research, due diligence, and consideration of alternative options. Exploring reputable debt relief alternatives and consulting with financial professionals or credit counseling agencies may provide a more reliable and secure path to debt resolution.

Additionally, it is advisable to review any contracts or agreements with Option 1 Legal carefully, paying close attention to the fee structure, cancellation policies, and the specific services they promise to provide. Transparency and clear communication are vital factors when engaging with any debt relief company.

Ultimately, the decision to work with Option 1 Legal rests on your assessment of the available information, your comfort level, and your individual circumstances. However, based on the negative reviews and concerns raised, it may be prudent to approach this company with caution and explore other reputable options in the realm of debt relief.

Remember, financial decisions have long-lasting consequences, and it is essential to prioritize your financial well-being by making informed choices and seeking professional advice when necessary.