Did you recently receive a consolidation loan mailer from a company you had never heard of? Curiosity got the better of you, and after visiting their website, you decided to enroll with Boulder Legal Group. However, during a phone call, they informed you that you didn’t qualify for the consolidation loan but instead qualified for their consolidation program. Now you’re left wondering, who exactly is Boulder Legal Group and what do they offer?

Understanding Boulder Legal Group

Boulder Legal Group presents itself as a law firm specializing in debt settlement. It is worth noting that this company might be connected to a larger organization, given the similarities it shares with other firms in the same industry.

When evaluating such companies, it’s essential to gauge their credibility and gather information about their background. A notable aspect of Boulder Legal Group is the longevity of its website. According to the Wayback time machine, their website has been active for over seven years, suggesting that the company has been in operation for a considerable time.

Fees and Settlement Process

One concern that often arises when dealing with law firms in debt settlement is whether they charge fees before settling the debt. Unlike traditional debt settlement companies, some law firms may collect fees upfront. While reviewing the Boulder Legal Contract, I observed that fees may indeed be deducted from the initial drafts. Additionally, section 1.5 of the contract mentions that Boulder Legal Group can outsource customer service and debt negotiations to a third party. This arrangement implies that another debt settlement firm could handle the negotiations and receive payment from Boulder Legal Group. Consequently, this raises the possibility that the law firm may deduct fees before the first settlement, thereby allowing the contracted debt settlement company to receive fees prior to the debt’s settlement via the legal entity.

Affordability of Monthly Payments

Many individuals find it challenging to afford the monthly draft payment required when working with a debt settlement company. To assist individuals in understanding their options and the associated costs, we have developed a free debt resolution options calculator. The calculator, which does not even require an email address, provides a personalized estimate that allows you to explore cheaper, easier, and faster ways to get out of debt. If you’re interested, feel free to access the calculator and receive additional analysis from our team.

Boulder Legal Reviews

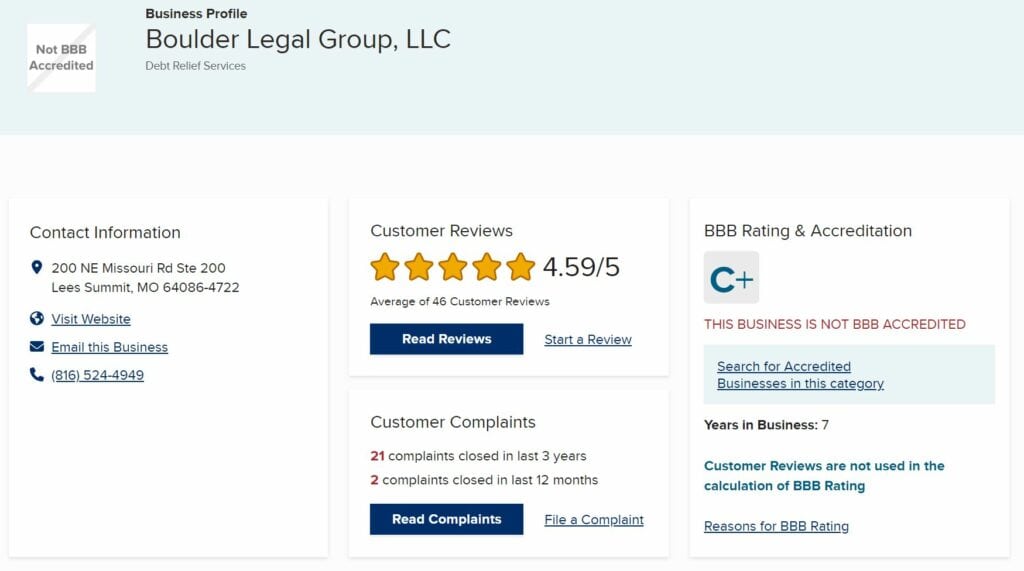

To assess the reputation of Boulder Legal Group, it is crucial to consider unbiased and comprehensive review platforms. Two such platforms are the Better Business Bureau (BBB) and Google Reviews. While the reviews may skew towards negativity, they provide valuable insights.

Better Business Bureau (BBB)

According to BBB, Boulder Legal Group currently holds a 4.44 rating based on 48 reviews, with a C+ rating. Initial impressions from several reviews indicate positive experiences, with customers expressing satisfaction with the customer service provided. However, there are also a few reviews highlighting difficulties in contacting Boulder Legal Group, failure to honor agreements and unsatisfactory debt settlement outcomes.

I went to Boulder Legal with high hopes of getting my debt paid off. The process started out great and I was assured that all of my debt would be paid off at the end of the five-year payment period. At first, they were very good and diligent about contacting me about the process. But as time went on, they were not so great. At one point, one of the creditors filed papers against me and I had to respond myself because Boulder Legal did not react to the papers that were served. I was very disappointed with their service. No one called me back regarding this even though I called several times. At the end of my program, no one contacted me about what to do now that the program was over. I had to call them to find out what was going on and to my dismay, I found out that two of my creditors weren’t even paid off. Then, to make matters even worse, one of the creditors filed a lien against me. I ended up having to file bankruptcy to get the lien off my property. I wish I would have filed for bankruptcy from the beginning and the entire process would be over by now and I would have saved myself thousands of dollars. I would not recommend Boulder Legal to anyone. “

On Google, Boulder Legal Group has a rating of 3.1 based on 79 reviews. Positive reviews primarily focus on the relief customers felt after having their accounts settled and debts cleared. However, many reviews express dissatisfaction with the company’s communication and the lack of responsiveness to phone calls.

Exploring Your Options

If you decide to continue working with Boulder Legal Group, it is essential to carefully review the Client Services Agreement in its entirety. Understanding why they charge fees before settlement, the specific services they offer, and the percentage fee they charge will help you make an informed decision. However, if you are considering canceling your program with Boulder Legal, contacting them directly might be an option. In some cases, assistance from your bank may be necessary if canceling the program proves challenging.

FAQs

1. Are there any red flags or concerns about the credibility of Boulder Legal Group?

Answer: Some clients have expressed concerns about Boulder’s credibility due to difficulties in contacting the company, failure to honor settlement agreements, and unsatisfactory debt settlement outcomes reported in customer reviews.

2. Can I trust Boulder Legal Group to handle my debt settlement effectively?

Answer: While Boulder Legal claims to specialize in debt settlement, mixed customer reviews indicate a lack of trust in their ability to handle settlements effectively. Complaints about poor communication and unmet expectations raise doubts about their reliability.

3. How transparent is Boulder Legal Group about its fee structure?

Answer: Some clients have reported a lack of transparency regarding fees charged by Boulder Legal Group. It is important to carefully review their Client Services Agreement and inquire about the specific percentage fee they charge for their services.

4. What is the level of customer support provided by Boulder Legal Group?

Answer: Negative reviews suggest that Boulder Legal Group’s customer support from lawyers may be lacking. Clients have mentioned difficulties in reaching the company and a lack of responsiveness to phone calls, leaving them feeling unsupported throughout the debt settlement process. This information doesn’t necessarily represent the experience of all the customers.

5. Does Boulder Legal Group have a satisfactory track record of successfully settling debts?

Answer: Customer reviews highlight instances where LLC Boulder Legal Group has failed to settle debts as promised. These reports raise concerns about their ability to achieve satisfactory outcomes for their clients.

6. Are there any potential drawbacks or risks associated with choosing Boulder Legal Group over other debt settlement firms?

Answer: Potential risks of working with Boulder Legal Group and seek advice includes the possibility of unmet settlement agreements, communication challenges, and potential fees being deducted before achieving successful debt settlements. These factors should be carefully considered when comparing options.

7. What happens if I want to cancel my debt settlement program with Boulder Legal Group?

Answer: Cancelling the program with Boulder Legal Group and their legal representation may prove difficult based on customer feedback. Some clients have reported challenges in canceling their program, potentially requiring assistance from their bank or seeking legal advice to navigate the process.

8. Is Boulder Legal Group proactive in providing updates and progress reports during the debt settlement process?

Answer: Negative reviews suggest that Boulder Legal Group may not be proactive in providing timely updates and progress reports to clients. This lack of communication can cause frustration and uncertainty for individuals seeking regular updates on their debt settlement journey.

9. Are there alternative debt settlement providers that offer more reliable services than Boulder Legal Group?

Answer: Considering the negative feedback and concerns expressed by clients, exploring alternative debt settlement providers with better reputations and track records might be advisable. Researching and comparing various companies can help identify alternatives that offer more reliable services.

10. What are the potential consequences of switching to a different debt settlement provider while enrolled in Boulder Legal Group’s program?

Answer: Switching to a different debt settlement provider while enrolled in Boulder Legal Group’s program may lead to additional complexities and potential financial implications. It is crucial to carefully review the terms of your agreement and seek professional advice to understand the potential consequences before making any changes.

Conclusion

Boulder Legal Group offers debt settlement services as a law firm, and their website has been active for several years. While the company has received positive feedback regarding its customer service and successful debt settlements, there have been complaints about communication issues and failure to meet agreed-upon terms. The decision to work with Boulder Legal Group or any debt settlement company should be made after careful consideration of the terms, fees, and alternative options available.

It is crucial to research thoroughly, read reviews from various sources, and assess your personal financial situation before committing to any debt settlement program. By doing so, you can make an informed decision and work towards a debt-free future that aligns with your financial goals.