Are you familiar with Bedrock Legal Group? Have you received a pre-qualification loan mailer claiming you’ve been approved for a fantastic interest-rate debt consolidation loan, only to find out later that you were not actually approved? This raises questions about the legitimacy of Bedrock Legal and its services. In this article, we will delve into the company’s background, explore customer reviews, and provide you with options to consider.

What is BedRock Legal Group?

BedRock Legal Group presents itself as a law firm specializing in debt settlement. It is worth noting that BedRock Legal might be affiliated with a larger organization, as there are similar firms in the industry. When evaluating such companies, it is important to examine the age of their website and gather as much information as possible about the company.

One interesting finding is that Phoenix Legal Group’s website, which seems related to BedRock Legal, has been active for over six years. This longevity suggests a level of establishment and experience compared to newer entities in the field.

On the footer of BedRock Legal Group’s webpage, it states that they are a debt relief agency, assisting individuals in filing for bankruptcy relief under the Bankruptcy Code. This information helps to establish the firm’s specialization and legal expertise.

Breaking Down Bedrock Legal Group Reviews

When assessing the reputation of a company, it is essential to consider unbiased and comprehensive reviews from reputable sources. In this case, we will turn to the Better Business Bureau (BBB), Google reviews, and Trustpilot reviews for insights.

BBB

Bedrock Legal currently holds a 1-star rating on BBB, based on 11 reviews. Moreover, it has received an F rating. Over the past three years, 66 complaints have been closed, with an additional 11 complaints closed within the last 12 months. These numbers raise concerns about Bedrock Legal’s practices. It is crucial to question whether another party might be enrolling individuals in Bedrock Legal Group’s services without the firm’s direct involvement. Notably, the F rating on BBB is alarming, as there is not a single review with a rating higher than 1 star for Bedrock Legal.

Terrible company. No communication. I enrolled in 2017 and was paying them almost $800 per month. When my program ended last August there was 1 account at $9,800 that was never addressed. I was told afterward this was to be concluded in a 1099c tax form. This never happened and the debt was sold to another collection company. I called Bedrock and said I want my money back for this account and was told no. How can a company charge for services not rendered? I was also dragged into court twice with no legal help from the company. Horrible company, nothing but smoke and mirrors.

Bedrock Legal’s performance is substandard at best. I entered into an agreement with this company in 2017 with 19k in credit card debt. I had a 48-month agreement to deposit $344 monthly into a firm called Reliant., to complete my debt resolution. After forty-two on-time payments of $344, with two exceptions when I was asked to pay an additional $50 for six months to accomplish a settlement. Reliant collected all the agreed-upon deposits. After $15,556 in deposits and two lawsuits, I still have over $12,000 in debt owed. To characterize Bedrock Legal, the company is a total con, based on the results I received. Now they are asking for more money, to continue. NEVER AGAIN!

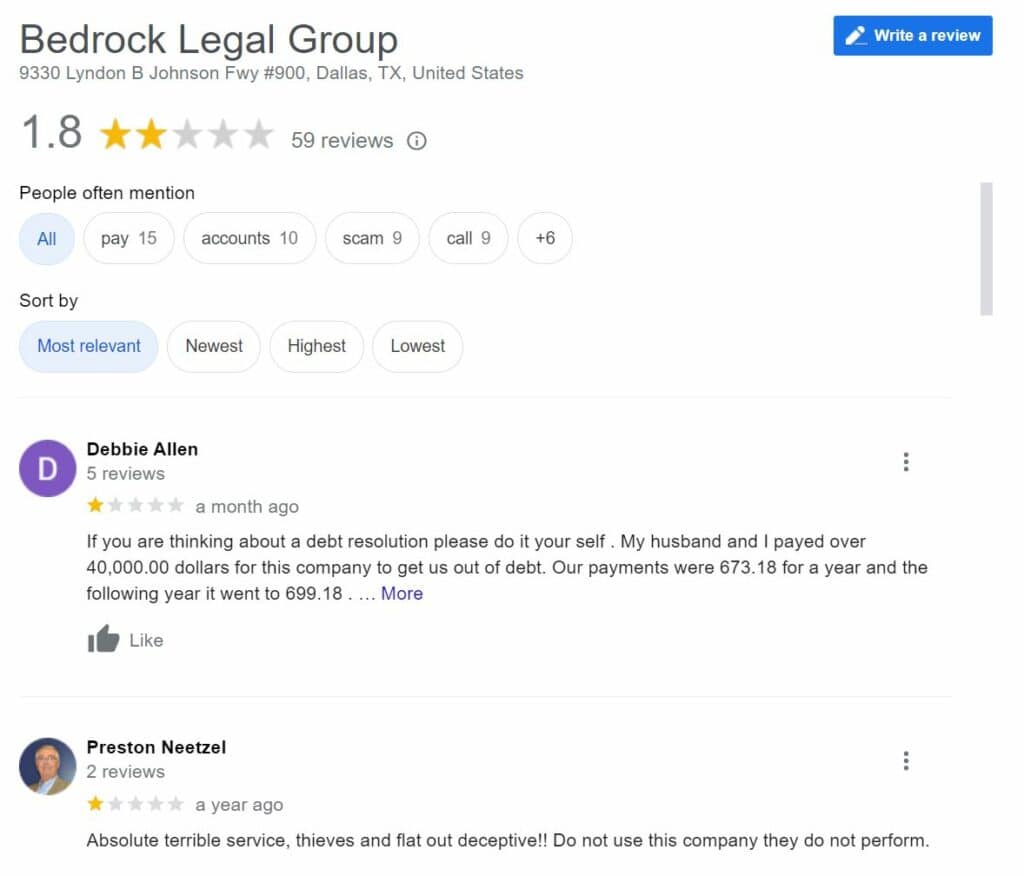

On Google, Bedrock Legal Group has a 1.8 rating, derived from 59 reviews. One particular review, which Google deems the most relevant, reveals a concerning practice: “They take all their fees upfront out of your payments and then start negotiations.” This statement suggests that Bedrock Legal deducts fees from clients’ payments before initiating negotiations, raising questions about their fee structure and the value provided in return.

Trustpilot

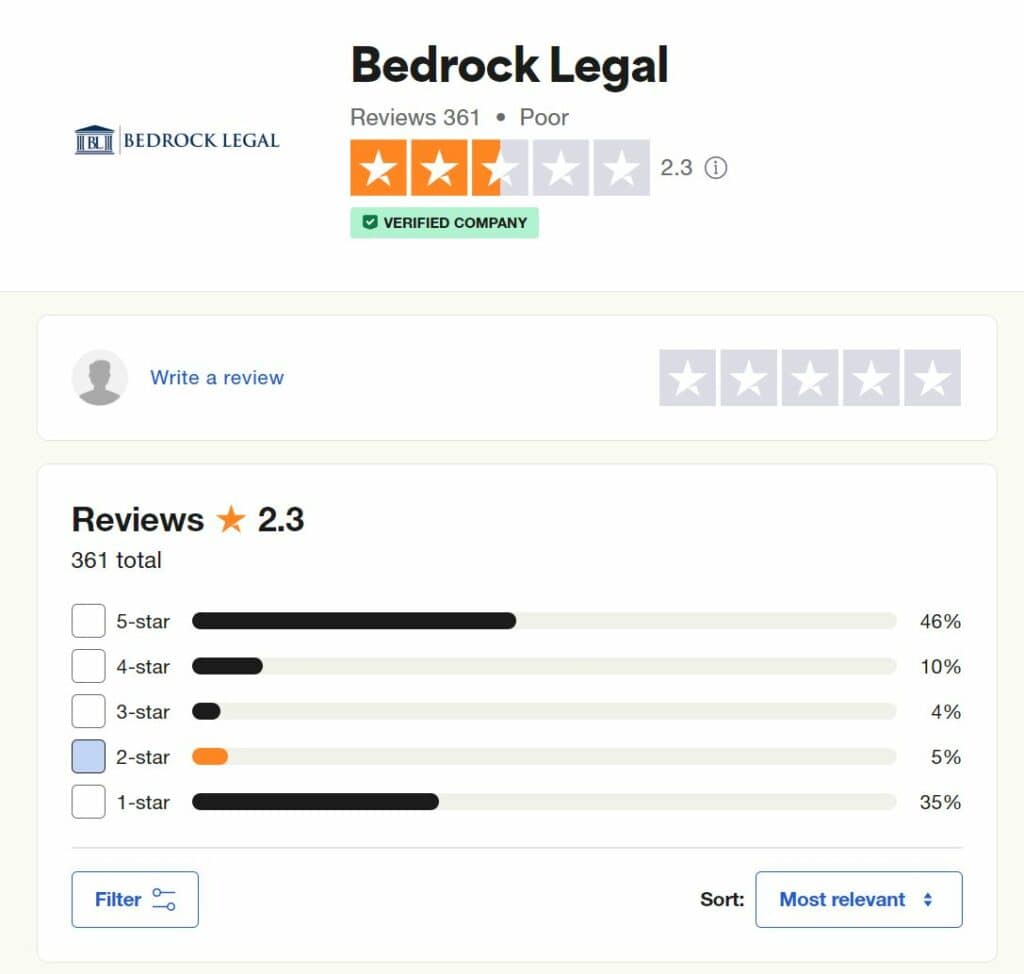

Bedrock Legal Group has amassed a larger number of reviews on Trustpilot, currently holding a 2.3-star rating based on 361 reviews. Although slightly higher than their rating on Google and BBB, the reviews on Trustpilot do not paint a significantly better picture.

What Can You Do Next?

If you find yourself considering options related to Bedrock Legal Group, there are a few things you can do. If you decide to continue with Bedrock Legal, it is essential to carefully read the Client Services Agreement. Pay particular attention to the fee structure and why they deduct fees before settling your debts. Understanding the value they provide and the percentage of fees charged is crucial for making an informed decision.

On the other hand, if you wish to cancel your engagement with Bedrock Legal, you may try contacting them directly. However, keep in mind that canceling the program might not be straightforward, and you may need assistance from your bank to facilitate the cancellation process.

Providing Subpar and Inadequate Legal Solutions

Spring Legal Group claims to offer comprehensive legal solutions, including evaluating prospective property deals, tenacious legal services, bankruptcy law, business litigation, and debt negotiation. However, their track record suggests a complete lack of competence and a tendency to provide subpar work.

Clients who have depended on Spring Legal Group for specialized assistance in overcoming challenges, protecting consumer rights, or resolving complex legal matters have often been left disappointed. The associates at Spring Legal Group lack the necessary expertise and fail to deliver the level of service expected. Businesses and individuals seeking reliable and efficient legal solutions should look elsewhere to avoid the pitfalls associated with Spring Legal Group’s inadequate practice areas and questionable account management.

FAQs

1. Is Bedrock Legal Group a legitimate law firm specializing in debt settlement?

Answer: Yes, Bedrock Legal Group presents itself as a law firm that focuses on debt settlement. However, it is important to consider customer reviews and ratings from reputable sources to evaluate the legitimacy and quality of their services.

2. What sets Bedrock Legal Group apart from other debt settlement companies?

Answer: Bedrock Legal claims to have expertise in debt settlement and offers services specifically related to filing for bankruptcy relief under the Bankruptcy Code. Their specialization in legal aspects of debt relief may differentiate them from other companies that solely offer debt consolidation or negotiation services.

3. Why does Bedrock Legal Group have a low rating on the Better Business Bureau (BBB)?

Answer: Bedrock Legal has a low rating on BBB due to customer complaints and negative reviews. These complaints might pertain to issues such as unsatisfactory services, high upfront fees, or lack of transparency in the fee structure. It is essential to thoroughly research and consider this feedback when assessing the company’s reputation.

4. Can I trust the reviews on Google and Trustpilot about Bedrock Legal?

Answer: Reviews on Google and Trustpilot provide insights from customers who have had experiences with Bedrock Legal. While these platforms can be helpful, it is crucial to critically evaluate the content and consider multiple sources to get a comprehensive understanding of the company’s reputation.

5. What is the Client Services Agreement, and why is it important?

Answer: The Client Services Agreement is a legally binding contract between the client and Bedrock Legal. It outlines the terms, conditions, and fees associated with their services. It is crucial to carefully read this agreement to understand the services being provided, the fee structure, and any potential risks or obligations before entering into a partnership with Bedrock Legal.

6. How does Bedrock Legal Group charge fees for its services?

Answer: Bedrock Legal’s fee structure can vary, but according to some reviews, they may charge upfront fees deducted from clients’ payments before initiating negotiations with creditors. It is important to clarify the fee structure and understand the specific terms before agreeing to their services.

7. What are the options if I decide to cancel my engagement with Bedrock Legal Group?

Answer: If you wish to cancel your engagement with Bedrock Legal, you can attempt to contact them directly. However, if they do not facilitate an easy cancellation process, you might need to seek assistance from your bank to stop any further payments or engagement with the company.

8. Are there any alternative debt settlement companies I should consider?

Answer: Yes, there are several reputable debt settlement companies in the market. It is advisable to research and compare different companies, considering factors such as customer reviews, industry reputation, fee structures, and the specific services they offer. Seeking recommendations from financial advisors or trusted sources can also be beneficial in making an informed decision.

9. Can Bedrock Legal Group provide references or case studies to showcase their successful debt settlement cases?

Answer: It is recommended to inquire with Bedrock Legal directly if they can provide references or case studies of successful debt settlement cases. Understanding their track record and success rate can give you a better sense of their capabilities and whether they are a good fit for your specific financial situation.

10. How can I protect myself from potential scams in the debt settlement industry?

Answer: To protect yourself from potential scams, it is essential to conduct thorough research before engaging with any debt settlement company. Look for reputable companies with positive customer reviews and ratings from reliable sources. Verify their credentials, check for any disciplinary actions or legal issues, and ensure they comply with applicable laws and regulations. Additionally, consult with a trusted financial advisor or attorney to get professional guidance and advice tailored to your unique circumstances.

Conclusion

In evaluating Bedrock Legal Group, we have uncovered concerning reviews and ratings from reputable sources like BBB, Google, and Trustpilot. The low ratings and negative reviews raise questions about the company’s practices, particularly regarding upfront fee deductions and the value provided to clients. It is crucial to conduct thorough research, read the fine print of any agreements, and carefully consider your options before committing to any debt settlement program.

Remember, making informed decisions about your financial well-being is of utmost importance. While Bedrock Legal Group’s marketing may sound appealing, it is essential to exercise caution and explore alternative options to ensure you choose a reputable and trustworthy service provider for your debt consolidation and settlement needs.