Debt consolidation can be a great option to improve your financial situation if you’re dealing with debt burden. By consolidating your debts into one single loan, you can save money on interest and get back on track financially. Alliance One Funding is a company that may have contacted you offering a debt consolidation loan with the following claims:

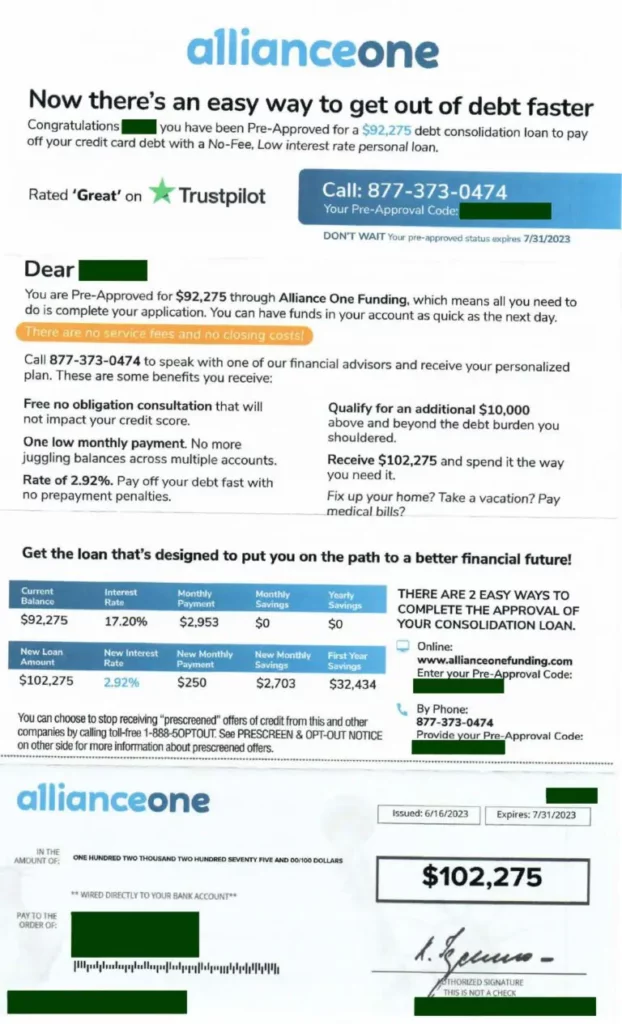

- You were pre-approved for a 2.92% interest rate on a debt consolidation loan.

- A check for over $100,000.

- Savings of over $2,700 per month.

- Your own personalized reservation code for easy application.

When it comes to finding a reputable debt consolidation company, it is crucial to shop around for different options and do your research. Alliance Once Funding seems to be an appealing option that offers low interest rates and convenient terms, but how can you determine if it’s a legitimate lender or another debt relief scam? In this review, we will present the results of our extensive research on the company, providing detailed information on how it works, its credibility, and what their customers have expressed about their experiences.

Alliance One Funding company overview

We took a closer look to help you decide whether or not Alliance One Funding is the right lender for you and uncovered some interesting facts during our investigation of their website and terms and conditions. Here are a few things that caught our attention:

- This company does not participate in any lending activities and therefore does not loan money. It is not a bank or financial institution.

- Alliance One Funding works with a network of independent lenders, each with its own set of standards.

- The loan amount, terms, and APR for each customer may vary depending on creditworthiness and state law.

- Minimum loan amounts vary by state.

- Lenders may not give credit to those who no longer meet the requirements after applying.

- Annual Percentage Rates (APR) range from 2.92% to 24.99%.

Is Alliance One Funding legit?

Alliance One Funding is not a lender but a company that helps connect borrowers with potential lenders. They act as a middleman in the process. Unfortunately, they do not have a BBB file, rating, or accreditation. They do have a Trustpilot verified account with a 3.4 rating.

Some clients have expressed satisfaction with Alliance One Funding’s services, while others have reported complaints. The presence of negative reviews does not necessarily indicate a scam, but potential clients should take precautions. Before making any decisions, check the company’s accreditations, read the company’s terms and conditions, and seek independent financial advice.

Part of the necessary research is reading customer reviews and experiences online to get a clear picture of what you could encounter when you decide to work with a financial institution.

Alliance One Funding customer reviews

There are no reviews of Alliance One Funding on the Better Business Bureau. In fact, they do not even have a file or accreditation. Not having a BBB file may not necessarily mean the company is a scam, but it does raise questions about its trustworthiness and customers’ experiences.

However, customer reviews for Alliance One Funding are available on Trustpilot. A total of 12 reviews have been left, with an average rating of 3.5 stars. Some reviews express skepticism about the authenticity of the positive reviews, noting similarities in writing style and a lack of previous reviews from the accounts. There was a negative experience reported by one reviewer, who cited communication problems, discrepancies in their credit reports, and negative credit effects. There are several positive reviews regarding Alliance One Funding’s professional competence, cooperation, and helpfulness in providing loans and debt relief services.

Below are two recent customer reviews:

What is Alliance One Funding?

According to Alliance One Funding, they offer debt relief solutions to businesses and individuals. They offer a range of services, including credit card debt consolidation programs, personal loans for debt consolidation, financial consultation services, and a smooth enrollment process that leads to a finalized payment plan. Finance managers at this company state their main goal is to assist clients in reducing debt, improving their credit, and achieving financial freedom. Additionally, Alliance One Funding claims that they work with a team of professional debt specialists who analyze their clients’ financial situation and develop a customized plan based on their specific needs.

There are many things to consider before choosing a financial company. One important factor is accreditation. Checking the Better Business Bureau (BBB) is a good way to see whether a company is accredited. Unfortunately, Alliance One Funding does not have a BBB file or accreditation. However, they do have a verified Trustpilot account with a 4.4 rating.

Alliance One Funding is located at 101 S. Reid St., Suite 307, in Sioux Falls, SD, and they can be contacted at (877) 373-0474 for more information.

How does Alliance One Funding operate?

Alliance One Funding, according to its website, specializes in providing financial solutions for individuals with high-interest unsecured debt. The process begins with a free consultation where a professional evaluates the client’s financial situation and discusses appropriate options. These solutions often involve debt consolidation or debt settlement programs. As part of the recommended debt relief program, Alliance One Funding negotiates with creditors on behalf of the client, aiming to reduce the total amount owed or to consolidate multiple debts into one low monthly payment if the client decides to proceed. While these programs can ease financial strain, they may also negatively impact a client’s credit score.

How to qualify for a Alliance One Funding loan

Alliance one funding takes a close look at your financial situation before approving your loan. They review your credit history and score, check your monthly expenses, and confirm your employment and income. Once they have all the information needed, the originating lender will decide if they approve or deny you a loan. Alliance One Funding is not the creditor for any accounts.

Alliance One Funding FAQs

How long does it take for a loan to be approved?

A loan may just take a little longer to come through depending on how many extra documents are requested. Your loan terms and conditions will be worked out based on your creditworthiness and state law.

How much does Alliance One Funding cost?

There is no clear indication of how Alliance One Funding generates revenue. There are no references to upfront fees on the website. Though they may receive referral fees, this is not made explicit.

How does Alliance One Funding affect your credit?

While a good or bad credit score can make a big difference in whether you’re approved for a loan, it’s important to remember that simply talking to a lender and initial credit checks will not have any impact on your score. The only way your score could potentially be lowered is by actually taking out the loan and having the lender hard check your history as part of the process.

Can I cancel my Alliance One Funding loan?

Taking out a personal loan is a big decision. Once you receive the funds, you can’t cancel or reverse the loan. Make sure you need the loan and are comfortable with the terms and conditions before accepting.

Are you having trouble making ends meet? Here are some suggestions that may help you get back on track.

- When it comes to your finances, having a budget is key to making sure you only spend what you can afford.

- Reach out to a financial advisor to discuss your options and develop a plan that meets your needs. With their help, you can make the best decisions for your future.

- Don’t give up hope just because you’re in debt. Many companies are happy to work with customers to set up a more manageable payment plan. So get in touch with their customer service team for more information.

If you’ve had any experience with Alliance One Funding in the past, positive or negative, we would like to hear about it in the comments below.