Dealing with debt can be a daunting and stressful experience. When faced with financial difficulties, many individuals seek the help of debt relief companies to assist them in finding a way out of their financial burdens. One such company is Whitestone Legal Group, a debt relief legal group based in Los Angeles, California. In this article, we will take a closer look at Whitestone Legal Group and explore its legitimacy based on various reviews and customer experiences.

What is Whitestone Legal Group?

Whitestone Legal Group company is a debt relief legal group that specializes in providing assistance to individuals struggling with debt. The company follows a debt relief approach where customers allow their accounts to fall behind, and Whitestone Legal Group negotiates with creditors to settle the accounts for less than what is owed. By doing so, they aim to provide individuals with a path toward debt resolution.

Company Details and Contact Information

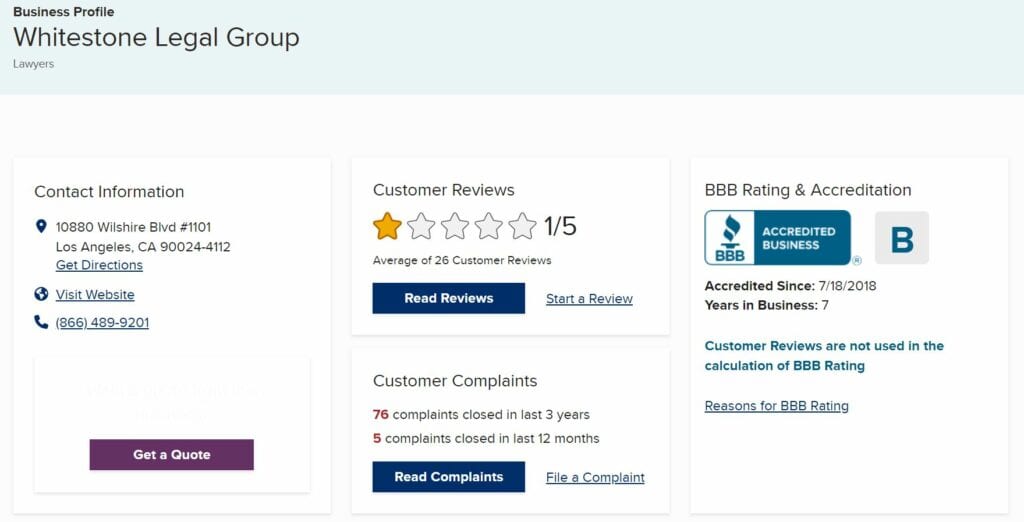

According to the Better Business Bureau (BBB), Whitestone Legal Group is located at 10880 Wilshire Blvd #1101, Los Angeles, CA 90024-4112. Their phone number is (866) 489-9201. These details are essential for individuals seeking to contact the company or verify its existence and legitimacy.

Whitestone Legal Group Reviews

When considering a debt relief company, it is crucial to assess its reputation and track record. In this case, we will examine reviews from various sources, including BBB, Google, Yelp, and TrustPilot, to gain a comprehensive understanding of Whitestone Legal Group’s performance and customer satisfaction.

BBB Reviews

The Better Business Bureau (BBB) is a trusted resource for consumers to assess the credibility of a company. Whitestone Legal Group currently holds a B rating from the BBB and is an accredited business. However, it is important to note that they have received a 1.0 rating based on 26 reviews and have had 80 complaints filed against them in the past three years. The significant number of complaints raises concerns about the company’s service quality and customer satisfaction.

Used this company to pay off credit cards, which were set up for 4 years, started off well but in the end, they did not pay off all of my cards and were trying to continue to charge me past the 4-year mark, also asked for extra money a few times. Do not use this company, very shady.

I began my program in October 2019 and have deposited over $11,500. Since that time I have had a judgment against me on the account that they were supposed to be negotiating, no action was taken on a settlement proposal of $8000 that I forwarded to Whitestone in 2020. Today, I received notification that there’s a settlement offer of $13,000 however they would only apply $5,610 of my savings toward the settlement, I would still pay monthly to them until September 2023 and then pay directly to the company for the difference of $8k. That would be me paying double what I owed originally. I want to contact my debtor directly and a full refund for doing nothing over 3 years. If I could give negative stars I would. The whole point of this was to settle this for the least amount possible. I have been unemployed since COVID hit and cannot afford to throw money away.

Google Reviews

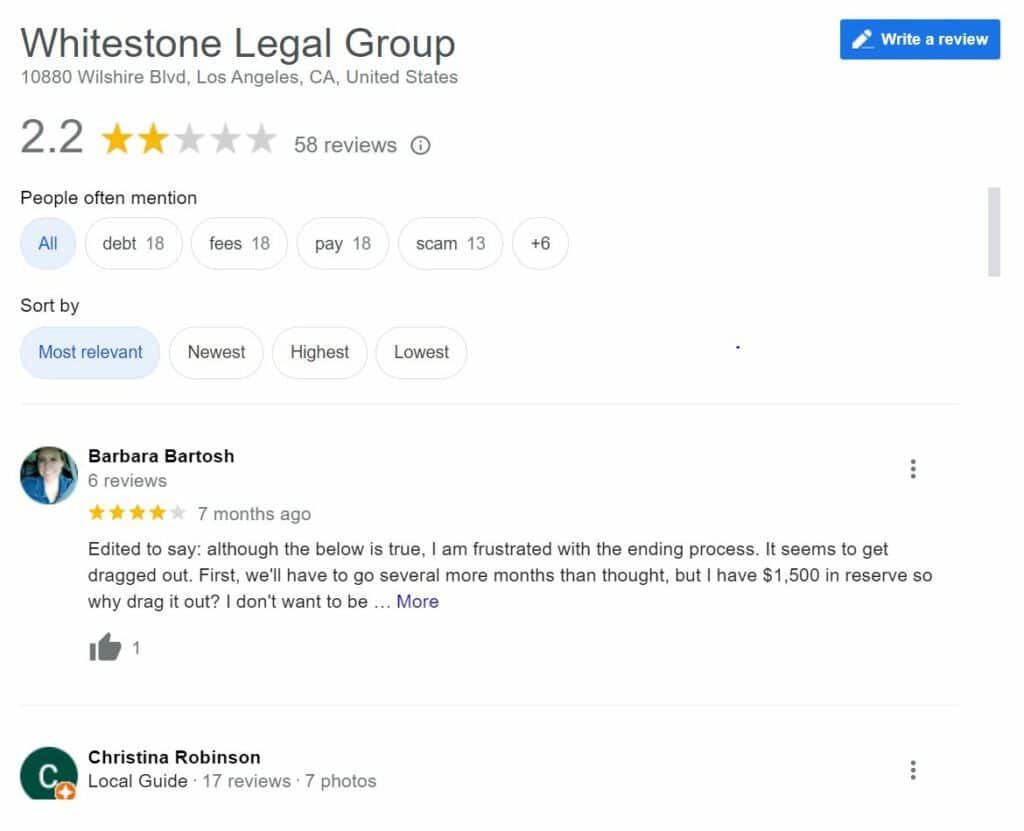

Another platform to consider when evaluating a company’s reputation is Google. At the time of this writing, Whitestone Legal Group maintains a 2.2 rating based on 56 Google reviews. While this rating is slightly higher than the BBB rating, it still indicates a mixed sentiment among customers. It is crucial to carefully read through individual reviews to understand the specific experiences and issues raised by customers.

Yelp Reviews

Yelp is another popular platform for customer reviews. Whitestone Legal Group has a 1.0 rating on Yelp, although this rating is based on only three reviews. It is worth noting that one of the reviews appears to be a duplicate of a BBB review. Due to the limited number of reviews, it is challenging to draw conclusive judgments solely based on Yelp ratings.

Trustpilot Reviews

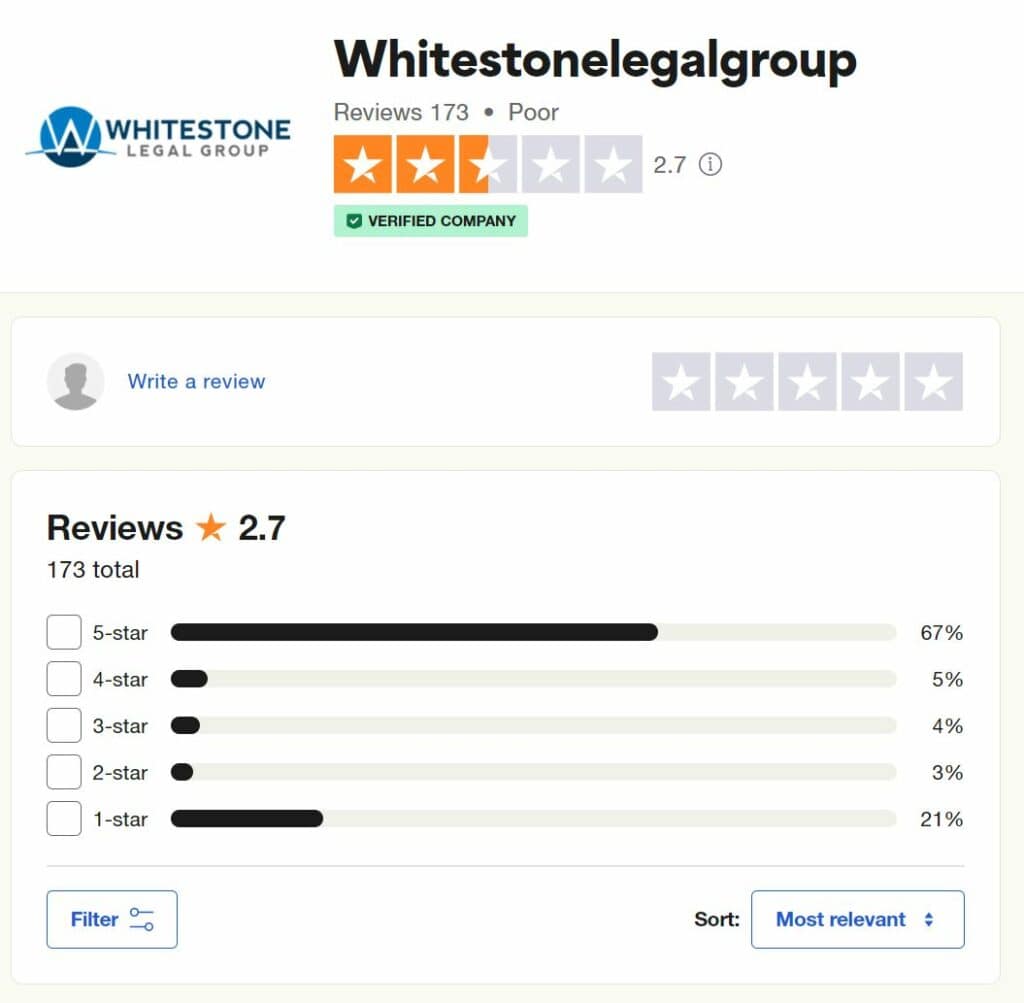

TrustPilot is a widely recognized platform for customer reviews, and it offers a more extensive pool of feedback for Whitestone Legal Group. Currently, the company holds a 2.8 rating on TrustPilot based on 172 reviews. While this rating is relatively higher than the ratings on BBB, Google, and Yelp, it is still indicative of mixed customer experiences.

One notable review on TrustPilot alleges that the company failed to make the final payments after settling an account, necessitating the re-settlement of the account. Such instances raise concerns about the company’s reliability and ability to fulfill its promises.

FAQs

How does Whitestone Legal Group differ from traditional debt consolidation services?

Whitestone distinguishes itself from traditional debt consolidation services by specializing in debt relief. Instead of consolidating debts into a single loan, it aims to negotiate with creditors to settle accounts for less than the amount owed, potentially reducing the overall debt burden.

What factors should I consider before choosing Whitestone Legal Group for debt relief?

Before selecting Whitestone Legal, it is essential to consider factors such as the company’s track record, customer reviews, accreditation status, all their fees, and transparency. Researching and comparing multiple debt relief options can help you make an informed decision.

Can Whitestone Legal Group help with all types of debt?

It primarily focuses on unsecured debts such as credit card debt, personal loans, and medical bills. However, it is crucial to consult with the company directly to determine if they can assist with your specific types of debt.

How long does the debt relief process with Whitestone Legal Group typically take?

The duration of the debt relief process can vary depending on individual circumstances and the complexity of the debts. While some customers may see progress within a few months, it is important to have realistic expectations and understand that the process may take several years to achieve satisfactory results.

Does Whitestone Legal Group offer a money-back guarantee if they are unable to settle my debts?

Whitestone does not explicitly mention a money-back guarantee on its website. It is crucial to review the terms and conditions of their services and discuss this aspect with the company directly before making any commitments.

What are the potential risks or drawbacks of working with Whitestone Legal Group?

While Whitestone Legal Group offers debt relief services, it is important to consider potential risks and drawbacks. These may include the possibility of lawsuits from creditors, damage to credit scores, and potential tax implications. Understanding and weighing these factors can help you make an informed decision.

How does Whitestone Legal Group determine the fees for their services?

Whitestone Legal Group determines its fees based on various factors, including the amount of debt, the complexity of the case, and the potential savings that can be achieved. It is crucial to have a clear understanding of the fee structure and any associated costs before proceeding with their services.

Can I continue using my credit cards while enrolled in Whitestone Legal Group’s debt relief program?

In most cases, individuals enrolled in Whitestone Legal Group’s debt relief program are advised to stop using their credit cards. Continuing to use credit cards may interfere with the debt relief process and hinder the negotiation efforts to settle accounts.

Are there any additional resources or educational materials provided by Whitestone Legal Group?

Whitestone Legal Group strives to provide educational resources and materials to help individuals make informed financial decisions. These resources may include budgeting tips, debt management strategies, and financial literacy information to empower individuals on their journey toward financial stability.

How can I contact Whitestone Legal Group to discuss my specific debt situation?

To discuss your specific debt situation with Whitestone Legal Group, you can reach out to them directly through their phone number at (866) 489-9201. It is recommended to schedule a consultation or speak with a representative to receive personalized guidance based on your unique circumstances.

Mismanagement and Unsatisfactory Legal Services

Whitestone Legal Group claims to provide legal services for individuals struggling with debt, promising to negotiate with credit card companies on their client’s behalf. However, many customers have expressed dissatisfaction with the company’s practices. They report being charged exorbitant fees, only to receive minimal monthly payment reductions and inadequate legal representation. Despite promising settlement offers, some clients have discovered that Whitestone Legal Group did not have enough funds to cover the settlements they negotiated.

Moreover, there have been numerous complaints and claims about funds being mismanaged or not used toward debt payments as promised. It appears that Whitestone Legal Group falls short of fulfilling its commitment to clients, leaving them frustrated and questioning the validity of the information provided. In some cases, customers have sought legal action, hoping for refunds or compensation for the lack of proper legal representation and the financial hardships caused by paying the company’s fees without satisfactory results.

Conclusion: Is Whitestone Legal Group a Scam or Legit?

Based on the reviews and ratings available, it is essential for individuals considering Whitestone Legal Group’s services to proceed with caution. The company’s B rating on BBB, coupled with a substantial number of complaints, suggests potential issues with customer satisfaction and service quality. Additionally, the mixed ratings on Google, Yelp, and Trustpilot indicate that experiences with Whitestone Legal Group can vary significantly.

It is crucial for individuals seeking debt relief services to thoroughly research and consider multiple options before making a decision. Understanding the reputation, track record, and customer feedback of a company like Whitestone Legal Group is vital to make an informed choice.

Ultimately, while Whitestone Legal Group may not be classified as a scam, the reviews and ratings raise concerns about its overall legitimacy and ability to provide satisfactory debt relief services. Therefore, individuals should exercise caution and explore alternative debt relief options, such as reputable non-profit credit counseling agencies or other well-established debt relief companies with a proven track record of success.

Remember, taking steps to address your financial situation is important, but it is equally crucial to make informed decisions that align with your best interests and financial well-being.