If you’ve recently received a mailer or ad from Harbor Legal Group offering a debt consolidation loan, only to find out that you don’t qualify but are eligible for their debt settlement program instead, you may be wondering about the legitimacy of this company. In this article, we’ll take a closer look at Harbor Legal Group, its reviews, and what you should consider if you’re considering working with them.

What is Harbor Legal Group?

Harbor Legal Group appears to be a law firm that specializes in debt settlement services. It is worth noting that it is not uncommon for such firms to be affiliated with larger organizations, as there are several similar companies in the market. When evaluating these firms, it’s important to examine their website and gather as much information as possible about the company.

Website History and Company Background

One interesting finding is that the Wayback Machine, a website archive tool, shows that the Harbor Legal Group’s website has been active for over 8 years. This suggests that the company has been operating for a significant period of time. However, it’s important to delve deeper and consider other factors before making a judgment.

Harbor Legal Group Reviews

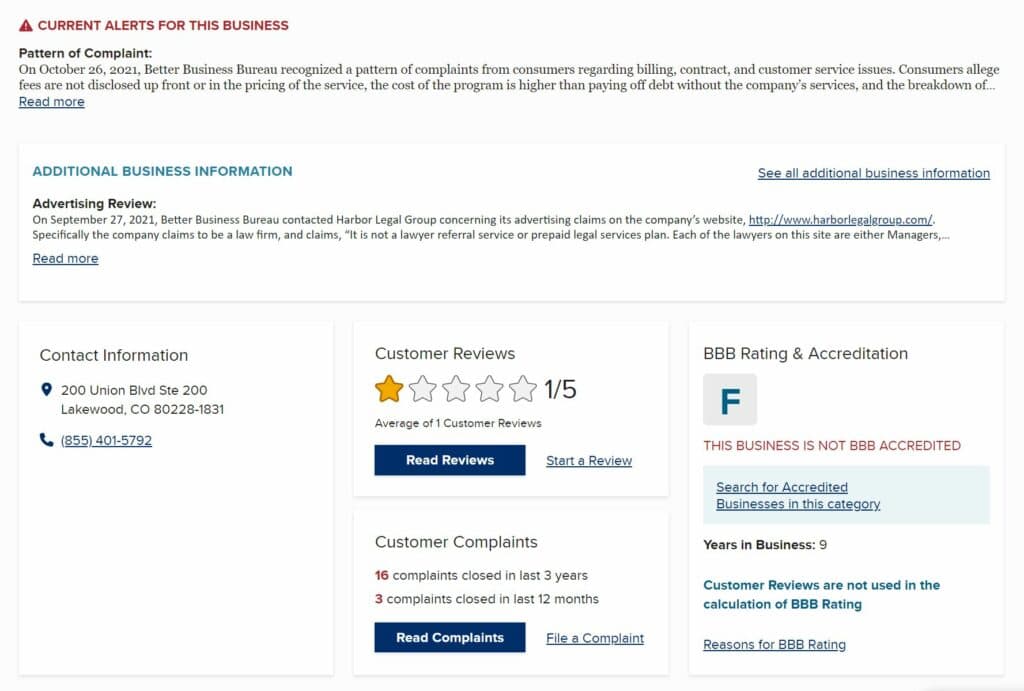

When it comes to evaluating the credibility of a company, unbiased and holistic review platforms are valuable sources of information. Two of the most commonly used review sites are the Better Business Bureau (BBB) and Google Reviews. Let’s take a closer look at what these reviews reveal about Harbor Legal Group.

BBB Reviews

Currently, Harbor Legal Group has a 1/5 rating on the BBB website, based on 2 reviews. Additionally, the company has received an F rating, indicating a pattern of complaints. These negative ratings raise concerns about the company’s practices and service quality. It is important to note that these reviews suggest the possibility of someone else signing people up for Harbor Legal Group, rather than the company itself engaging in direct marketing.

I entered into a legally binding agreement with this company; however, they did not hold up their end of the agreement. I paid over $33,000 for them to help me settle some debts. Over several years I made monthly payments, of which I made them all and toward the end of my plan even willingly agreed to make some extra payments in hopes of settling all my accounts. Well, they did settle most of my accounts except for the largest one which is now higher than it has ever been. Which I am still responsible for paying. After seeing all the fees on my last statement ( which I do not remember seeing on our initial agreement) I see why they couldn’t complete our legally binding agreement. Out of the funds they pocketed over $18,000. I get that you need to make a profit but if you can’t complete your end of the agreement then you need to come off of some of that pocketed money and keep your end of the agreement. I wish I had tried to settle my debt alone. At least then that $18,000 would have actually gotten to my debtors.

Harbor did get me in good standing at first and I made payments. However, they completely underestimated the time frame it would take to get me cleared up. So they just abandoned me and gave me the run around for over 2 years. No lie when I say that one day I was so determined for them to resolve my situation that I waited on hold for over 3 hours. Nothing was resolved that day though. Now I’ve received notification that they are completely absolving themselves from me and I owe more than I would have if they helped me 2 years ago. I pray I may find a way to pursue successful legal action against them. Awful, horrible all-around experience. Please stay away.

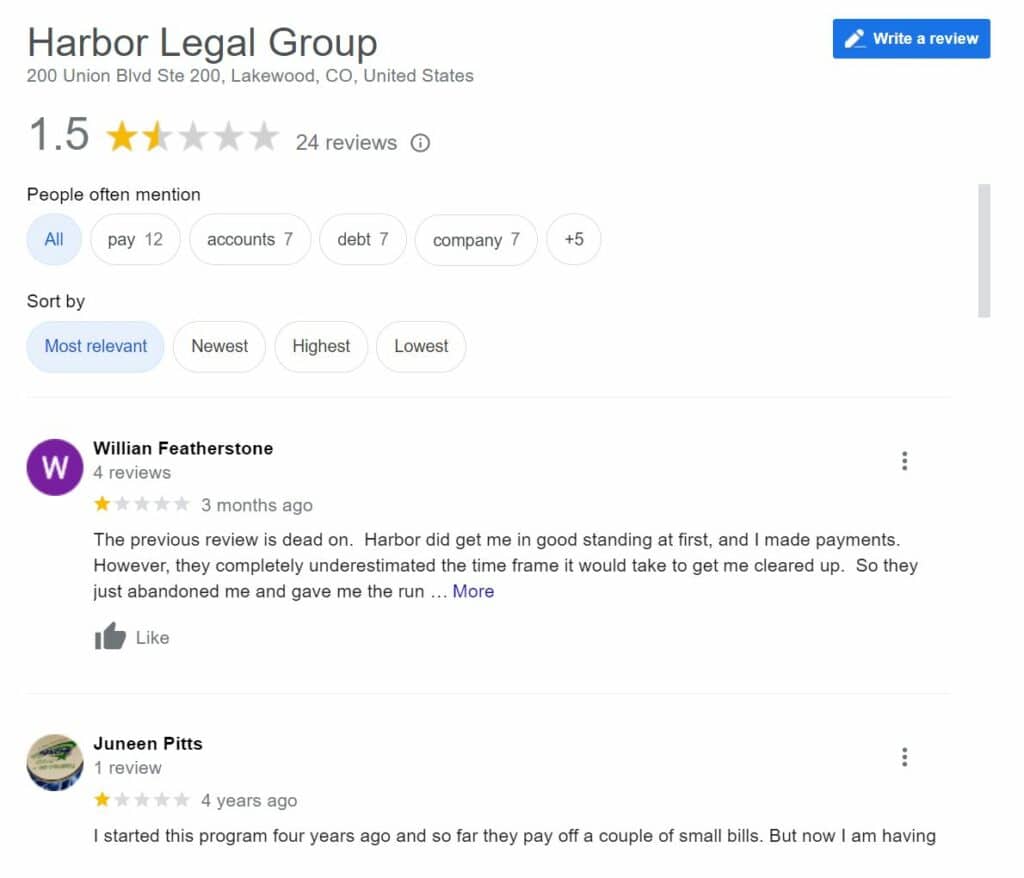

Google Reviews

On Google, Harbor Legal Group has a 1.5 rating based on 24 reviews. One reviewer mentioned that they were given the runaround by Harbor Legal Group and spent over 3 hours on hold when trying to resolve an issue. After leaving a negative review and filing a complaint with the BBB, the legal group reached out to the reviewer to rectify the situation. However, upon rejoining the program, the same problems resurfaced, indicating a lack of resolution on the company’s part.

Things To Consider

If you are considering continuing in the program with Harbor Legal Group, it is crucial to conduct thorough research on your own and carefully review their Client Services Agreement. Here are some questions to ask yourself:

- Why are they charging fees before taking any action?

- What specific actions are they undertaking on your behalf?

- What percentage of fees are they charging you?

It is important to have a clear understanding of the company’s fee structure and the services they provide before proceeding.

If you decide to cancel your involvement with Harbor Legal Group, you may attempt to contact them directly. However, if they prove difficult to reach or refuse to cancel the program easily, you may need to seek assistance from your bank or financial institution.

FAQs

How does Harbor Legal Group compare to other debt settlement companies?

Harbor Legal is one of many debt settlement companies available. It’s important to research and compares multiple companies to understand their differences in terms of experience, success rates, fees, and customer reviews to determine the best fit for your specific needs.

What factors should I consider when comparing the fees charged by Harbor Legal Group with other debt settlement firms?

When evaluating fees, it’s crucial to consider the percentage or amount charged by Harbor Legal in relation to the total debt being settled. Additionally, compare these fees with those of other reputable debt settlement companies to ensure they are competitive and reasonable.

Does Harbor Legal Group have any eligibility criteria for clients with low credit scores?

Harbor Legal Group assists clients across a wide range of credit scores. While having a low credit score may not disqualify you from their services, it’s important to discuss your specific situation with them to understand the feasibility and potential outcomes of debt settlement.

What level of support can I expect from Harbor Legal Group throughout the debt settlement process?

Harbor Legal Group aims to provide support to clients during the debt settlement process. However, it’s essential to understand that the extent of support may vary, and it’s advisable to communicate your expectations and ask specific questions about the level of support they offer.

How long can the debt settlement process take with Harbor Legal Group?

The duration of the debt settlement process can vary significantly depending on factors such as the number of creditors, the amount of debt, and the willingness of creditors to negotiate. Harbor Legal Group will provide an estimate based on your specific circumstances, but it’s important to be prepared for the process to take several months or even years.

How can I ensure that Harbor Legal Group negotiates with my creditors in good faith?

While Harbor Legal Group has a reputation for successful negotiations, it’s important to maintain open communication and stay informed throughout the process. Regularly check the progress, ask for updates, and review any settlement offers to ensure they align with your goals and expectations.

Is Harbor Legal Group compliant with all necessary licenses and regulations?

Harbor Legal Group operates as a law firm and should be compliant with relevant licenses and regulations. It’s advisable to verify their licensing information and check if they are registered with appropriate regulatory bodies before engaging their services.

What options do I have if I am not satisfied with the outcome of the debt settlement process with Harbor Legal Group?

If you are dissatisfied with the outcome, discuss your concerns with Harbor Legal Group. They may have processes in place to address such situations. It’s important to understand the terms of your agreement and any potential remedies available to you in case of unsatisfactory results.

Can Harbor Legal Group assist with all types of debt, including credit cards, medical bills, and personal loans?

Harbor Legal Group primarily focuses on unsecured debts, which can include credit cards, medical bills, and personal loans. However, it’s important to provide them with a detailed overview of your debts during the consultation to ensure they can handle your specific situation.

Does Harbor Legal Group provide educational resources or financial counseling to help clients manage their debts beyond debt settlement?

While debt settlement companies may provide some educational resources, it’s essential to discuss this aspect with Harbor Legal Group directly. Additionally, consider seeking additional financial counseling or educational resources to gain a comprehensive understanding of debt management and financial well-being.

Harbor Legal Group Difference

Unfortunately, the Harbor Legal Group fails to live up to its promises when it comes to matters involving business litigation and personal debt issues. Despite claiming to understand the complexities of both business litigation and personal lifestyles, their lawyers often fall short of providing successful legal action. Clients facing credit card debt or other personal financial challenges may find themselves completely underestimated and overwhelmed by the lackluster service provided.

Phone calls go unanswered, and the professional help promised turns out to be nothing more than empty words. The time frame for resolution remains uncertain, leaving clients in a state of limbo. Instead of receiving the much-needed support and guidance, individuals are left disappointed and frustrated, having received little to no notification about their legal options. The Harbor Legal Group fails to deliver on its claims, leaving clients to navigate their debt issues with little assistance and no real resolution in sight.

Conclusion

In conclusion, the negative reviews and complaints surrounding Harbor Legal Group, as evidenced by the low ratings on BBB and Google, or Trustpilot Reviews indicate serious issues with the company’s practices and customer satisfaction. Extended hold times, lack of communication, and failure to deliver on promised services are common grievances reported by clients. These concerns should not be taken lightly when considering engaging with Harbor Legal Group or any debt settlement company.

It is crucial to approach debt settlement with caution and thorough research. Based on the negative feedback and patterns of complaints, it is advisable to explore alternative options and consider working with reputable companies that have a proven track record of positive client experiences. Seeking guidance from certified financial professionals and reviewing various debt relief alternatives such as credit counseling or debt consolidation loans can provide a more reliable and trustworthy path toward resolving your debt issues.

Remember, your financial well-being is at stake, and it is essential to prioritize companies that prioritize your satisfaction and success in achieving debt relief. Taking the time to thoroughly evaluate debt settlement options will lead to a more informed decision and increase the likelihood of finding a reputable company that can effectively meet your needs.