If you’ve recently received a pre-approved loan offer in your mailbox from Brookwood Loans, it’s crucial to tread carefully. These offers can seem like a quick fix to your financial woes, but they often come with high interest rates that can exacerbate your financial situation. Before you decide, let’s dive deeper into what Brookwood Loans offers, its pros and cons, customer experiences, and what you should watch out for.

UPDATED MAIL OFFER 2024

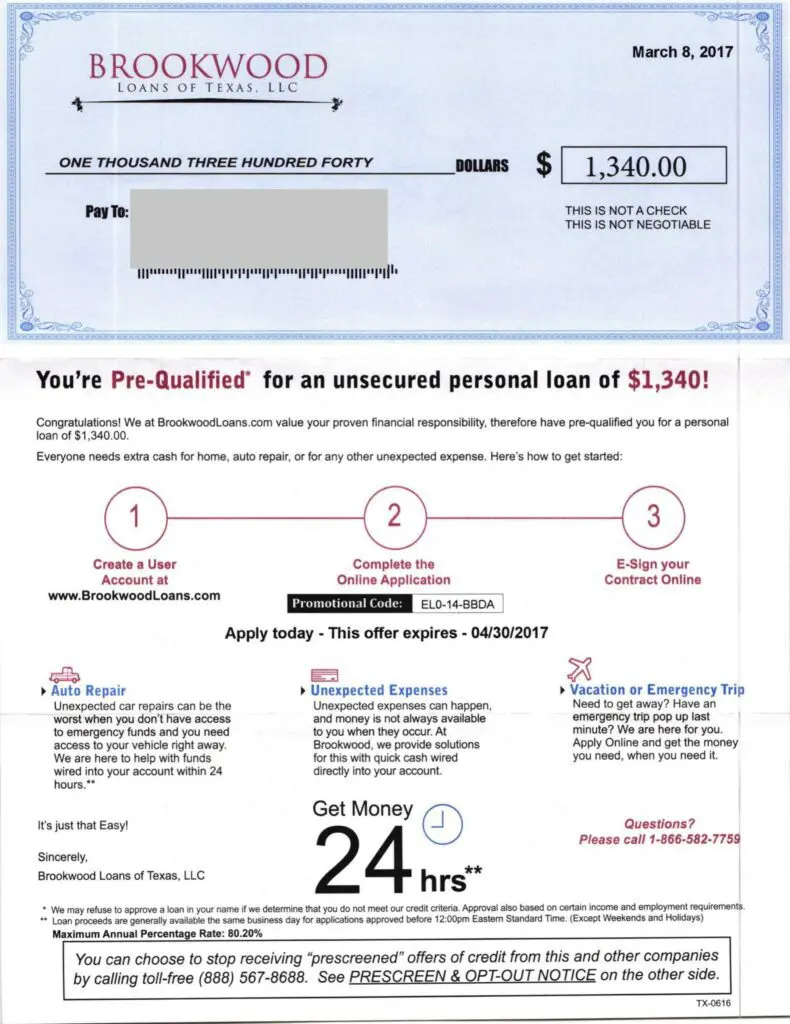

Brookwood’s Pre-Approved Mail Offers

Receiving a pre-approved loan offer from Brookwood Loans in your mailbox might feel like a beacon of hope, especially if you’re in a tight financial spot. These offers claim to provide a quick and easy way to get the cash you need. However, it’s crucial to approach these offers with a critical eye.

Pre-approved offers often come with conditions that may not be immediately clear or are buried in the fine print. One of the most critical aspects to watch out for is the interest rate. Some customers have reported exceedingly high-interest rates, with figures reaching as high as 80% in some cases. These rates can significantly increase the total amount you’ll have to pay back, making a seemingly small loan turn into a large debt over time.

Moreover, while the idea of getting money quickly and with minimal fuss is appealing, it’s essential to consider why you’re receiving such an offer. Companies like Brookwood Loans often target individuals who may not have many other financial options due to their credit history. While this doesn’t necessarily mean their services are inherently bad, it does mean you should proceed with caution and fully understand the terms you’re agreeing to.

Before accepting any pre-approved loan offer, take the time to:

- Read the Fine Print: Understand all the terms and conditions, especially regarding interest rates, fees, and the repayment schedule.

- Compare Offers: Look at what other lenders are offering. Sometimes, the first offer you receive might not be the best one available to you.

- Consider Alternatives: Depending on your situation, there might be other, more cost-effective ways to address your financial needs.

Remember, while a pre-approved offer might seem like an easy out, it’s essential to make informed decisions to protect your financial health in the long run.

Brookwood Loans Overview

Brookwood Loans is a financial services provider that offers personal loans to individuals who may not have access to traditional banking options due to their credit history. Based in Alpharetta, Georgia, with an additional office in Virginia Beach, Virginia, Brookwood Loans positions itself as a solution for those in need of quick financial assistance. Here’s a quick overview of what you need to know about them:

- Office Locations and Contact Information:

- Georgia Office: 3440 Preston Ridge Rd. Suite 500, Alpharetta, GA 30005

- Virginia Office: 2901 South Lynnhaven Rd. Suite 360, Virginia Beach, VA 23452

- Customer Service: 1-866-582-7759

- Virginia Residents: 1-855-784-2555

Brookwood Loans offers the promise of fast and easy loans, claiming to provide a seamless application process that can quickly get you the funds you need. Their online presence suggests a streamlined service, with a focus on customer convenience and speed of delivery.

However, it’s important to keep in mind the feedback from customers regarding their experiences. High-interest rates and the impact on long-term financial health are notable concerns raised by some borrowers. Potential customers are encouraged to thoroughly understand the terms and conditions of any loan offer, including the interest rates, repayment schedule, and any fees associated with the loan.

Choosing Brookwood Loans means opting for a quick solution that may come with its own set of challenges, especially for those already facing financial difficulties. As with any financial decision, it’s crucial to weigh the pros and cons, considering your current situation and future financial health.

Brookwood Loans Services

Brookwood Loans provides a range of financial services designed to meet the immediate needs of individuals facing financial challenges. Their primary offering is personal loans, which are typically unsecured loans that do not require collateral. These loans are intended for personal use, whether it’s for consolidating debt, covering unexpected expenses, or financing a large purchase. Here’s a closer look at the services offered by Brookwood Loans:

- Personal Loans: Brookwood Loans offers personal loans that can be used for a variety of purposes. The application process is advertised as fast and straightforward, with the potential for funds to be deposited into your account quickly after approval.

- Fast Funding: One of the key features of Brookwood Loans is their promise of fast funding. For individuals in urgent need of financial assistance, Brookwood claims to provide a swift solution, potentially wiring funds to your bank account within 24 hours of approval.

- Online Application: The entire loan application process with Brookwood Loans can be completed online. This convenience allows applicants to submit their information and receive a decision without the need to visit a physical office.

While these services can be appealing, especially for those in dire need of quick cash, it’s essential to proceed with caution. The ease of access to funds can come at a cost, typically in the form of higher interest rates compared to traditional bank loans. These rates can significantly affect the total amount you will end up paying back.

Before deciding to take a loan from Brookwood Loans or any other lender, consider exploring all your financial options. Sometimes, alternative solutions might better suit your long-term financial health and goals.

Brookwood Loans Pros and Cons

When considering Brookwood Loans for your financial needs, weighing the advantages and disadvantages is crucial. Here’s a breakdown of the pros and cons to help you make a more informed decision:

Pros:

- Quick Access to Funds: One of the primary benefits of Brookwood Loans is the speed at which you can access the funds once approved. This can be particularly helpful in emergencies where you need cash fast.

- Simple Application Process: Their online application process is straightforward and can be completed in just a few minutes, making it convenient for those who prefer not to go through lengthy loan approval processes.

- No Collateral Required: The loans offered are unsecured, meaning you don’t need to put up any collateral like your home or car, which can be a relief for borrowers not willing to risk their assets.

Cons:

- High Interest Rates: The most significant downside to Brookwood Loans is the potentially high interest rates. These rates can make it difficult for borrowers to pay back the loan without incurring significant extra costs.

- Impact on Credit Score: If you’re unable to meet the repayment terms, there’s a risk of damaging your credit score, which can affect your ability to secure loans in the future.

- Potential for Debt Cycle: The ease of getting a loan from Brookwood can lead to a cycle of debt for some individuals. Borrowing more than you can afford to pay back, especially at high interest rates, can lead to a challenging financial situation.

It’s essential to carefully consider these pros and cons in the context of your financial situation. Always explore other financial avenues and compare loan terms from different lenders before making a decision.

Brookwood Loans Reviews, BBB Reviews, Trustpilot Reviews

Understanding what other customers have experienced with Brookwood Loans can provide valuable insights into what you might expect. Reviews on platforms like Yelp, the Better Business Bureau (BBB), and Trustpilot reflect a range of experiences, from satisfaction with the convenience and speed of service to concerns over the costs associated with loans. Here’s an overview of what some of these reviews highlight:

Yelp Reviews:

- Customers have pointed out high interest rates as a significant issue, with some mentioning rates as high as 80% on approval letters. This aspect has led to dissatisfaction among borrowers who found themselves paying back much more than they borrowed.

- Positive reviews often mention the quick access to funds and the straightforward application process, which were crucial for customers in urgent need of financial assistance.

BBB Reviews:

- Brookwood Loans is not BBB accredited, which is a factor that some individuals consider when evaluating the trustworthiness and reliability of a company. However, accreditation is not a requirement for businesses, and its absence does not necessarily reflect poorly on a company’s service quality.

- Specific reviews and complaints on the BBB site were not accessible at the time of research, suggesting potential technical issues or limitations in the available information.

Trustpilot Reviews:

- There was limited information available regarding Trustpilot reviews for Brookwood Loans during the search. Trustpilot is another platform where customers can leave feedback, and it can be a useful resource for prospective borrowers to check for additional reviews.

In summary, while some customers appreciate the quick and easy access to loans that Brookwood Loans offers, high interest rates and the impact on long-term financial health are significant concerns. It’s crucial to read through various reviews and consider all aspects of taking out a loan before making a decision.

Brookwood Loans Customer Experiences

The experiences of customers who have borrowed from Brookwood Loans provide valuable insights into what future borrowers might expect. These experiences can range widely, reflecting the diverse financial situations and needs of borrowers. Here’s a summary of the customer experiences shared in reviews and feedback:

Positive Experiences:

- Quick Resolution to Financial Emergencies: Many customers have expressed satisfaction with the speed at which they receive funds, highlighting Brookwood Loans as a lifeline during urgent financial needs.

- User-friendly Application Process: The online application process has been praised for its simplicity and efficiency, allowing borrowers to apply for loans without the hassle of paperwork or in-person visits.

- Helpful Customer Service: Some borrowers noted that customer service was helpful and informative, providing clear answers to questions and assistance throughout the loan process.

Negative Experiences:

- High Interest Rates and Fees: A common concern among borrowers relates to the high-interest rates and fees associated with loans from Brookwood Loans. Some customers reported being caught off guard by the total cost of repayment.

- Difficulty in Repayment: Due to the high interest rates, some borrowers found it challenging to keep up with payments, leading to financial strain and, in some cases, a cycle of debt.

- Impact on Credit Scores: Customers who struggled with repayment mentioned negative impacts on their credit scores, complicating their financial situations further.

Key Takeaway: Customer experiences with Brookwood Loans underscore the importance of thoroughly understanding loan terms, including interest rates and repayment schedules, before accepting a loan offer. While Brookwood Loans may offer the quick financial assistance you need, ensure it aligns with your ability to repay without compromising your financial health.

Brookwood Loans BBB Reviews

Brookwood Loans is not accredited by the Better Business Bureau (BBB), but they do have an A+ rating from the BBB. They have 1 complaint closed in the last 3 years.

Here are some reviews:

Initial Complaint 11/08/2021

Complaint Type: Advertising/Sales Issues Status: Answered

I am a victim of identity- theft, I am writing to request that you block all accounts disputed as fraudulent on my credit reports with Transunion, Equifax, and Experian. This information does not relate to any transactions I have made.

I did not give anyone authorization or consent to use my personal information.

I hereby exercise my legal rights enacted by Congress and The ************************* which explicitly states when a victim of identity-theft disputes a fraudulent account on his/her credit report it shall be honored by all credit bureaus and all fraudulent information should be blocked within 4 days and proper notification shall be given to all data furnishers pursuant to section 605b of The Federal Fair Credit Reporting Act.1. BROOKWOOD ball. $0.00 Acct # ***-****

Conclusion

Opting for a loan from Brookwood Loans can be a viable solution for those in immediate need of financial assistance. The company’s quick funding times, straightforward application process, and availability to borrowers with less-than-perfect credit make it an appealing choice for many. However, it’s crucial to approach with caution due to the potential for high-interest rates and the impact on your financial health over the long term. Always consider your ability to repay the loan under the agreed terms, and explore other financial options that may be available to you. Making an informed decision is key to managing your finances wisely and avoiding future financial strain.

Brookwood Loans FAQs

When considering a loan from Brookwood Loans, you may have several questions about their services, terms, and processes. Here are some frequently asked questions that might help clarify any uncertainties:

Q1: How quickly can I receive funds from Brookwood Loans?

- A1: Brookwood Loans prides itself on its fast funding times. If approved, you could receive the funds in your bank account as quickly as within 24 hours.

Q2: Are there any requirements to qualify for a loan?

- A2: While Brookwood Loans aims to serve a broad range of borrowers, including those with less-than-perfect credit, certain criteria must be met. These may include age, employment status, income level, and residency requirements. It’s best to consult their website or customer service for specific eligibility details.

Q3: Can I repay my loan early, and are there any penalties for doing so?

- A3: Brookwood Loans typically allows early repayment of loans without penalty. This can be a great way to save on interest if you find yourself able to pay off the loan sooner than expected.

Q4: What should I do if I’m struggling to make my loan payments?

- A4: If you’re facing difficulties making your loan payments, it’s crucial to contact Brookwood Loans as soon as possible. They may offer options to help manage your payments and avoid defaulting on the loan.

Q5: How can I apply for a loan with Brookwood Loans?

- A5: Applying for a loan with Brookwood Loans is done entirely online through their website. The process is designed to be quick and straightforward, requiring basic personal and financial information.

Remember, it’s essential to read all terms and conditions carefully before agreeing to a loan, and consider whether the loan fits your financial situation and needs.